So I recently did an AOR (App-O-Rama) and the Wells Fargo Active Cash was one of the cards I applied for and failed to get. The datapoints in the denial letter are interesting.

I have had an Wells Fargo Personal Checking account for several months now. I opened it for the $325 sign up bonus. I received the bonus a couple months back and have been direct depositing over $500 into it each month to avoid the monthly maintenance fee — quickly withdrawing it after leaving just under $50 dollars in the account at all times.

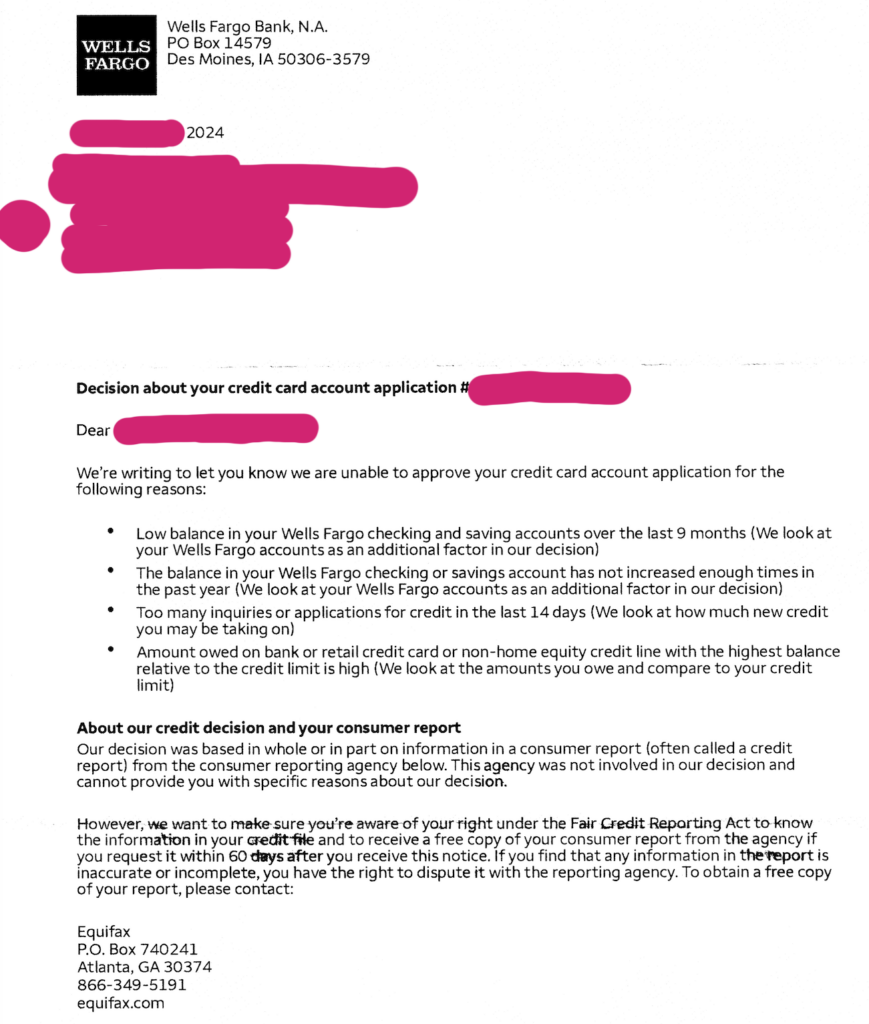

They denied me for the Wells Fargo Active Cash four listed reasons. See scanned letter below.

Amount of Money in Deposit Account(s). I find all the reasons interesting, especially the first two: they appear to not like it when you have a deposit account(s) with them — as I do — and not have any substantial amount of money in them.

Too Many Inquires in Past 14 days. I didn’t know they look at this time period specifically. It is not mentioned in DoC’s 18 Things to Know About Wells Fargo Credit Cards.

High Balances Relative to Credit Limit On A Single Card. I have over 10 personal cards, most of them with zero balances. I do however have a Chase Freedom Flex at 98% capacity — taking advantage of the 0% APR. However my overall credit utilization is only 9%.

So these are all things I can easily fix in the future when I re-apply:

- I’ll just make sure to have more money in the Wells Fargo Checking account — or maybe no checking account at all with them, to avoid this altogether?

- I’ll be sure not to apply for any other credit cards 14 days prior.

- I’ll pay down any personal credit cards with high balances relative to credit limit.

Equifax. Oh I want to add, that for me at least, the only credit bureau hit was Equifax, which is a good thing since I have relatively little hard inquires on that compared to TransUnion and Experian.

What other cards did you apply for and get? I didn’t think people still did AORs with all the new rules.

I got approved for the Citi ShopYourWay the other day. They pulled EQ. I have EX frozen, but I doubt that influenced which one they pulled.

I applied for 14 cards over two day period and have been approved for 7 with 3 pending still. I successfully obtained the Citi SYW, Synchrony Premier, BOA Customized Cash, BOA Premium Rewards, BOA Business Unlimited Cash, Discover It Miles and Amex Personal Gold.

Wow! That’s an impressive haul.

Did you already have a lot of open cards? Sounds like you gave up on further Chase for a while. 😀

Yeah I was 6/24 and would of had to wait like 1.25 years before I could get another personal card. I had several personal cards I’ve been wanting and well I just went for it. Will be gardening soon again for Chase cards in the future.

I was 6/24 myself and decided to go for Barclays Hawaiian. Auto approved. Also tried Barclays Wyndham Biz to consolidate the pull, but that one went into review.

At this point, I won’t be 4/24 again until like July 2026. 😀

I guess I should go for some Amex’s if I can get out of pop up jail.

Did any of your 3 pendings get approved?

It looks like the Synchrony has no SUB. Is there a reason that you went for that one?

I tried applying for Wells with the big 3 frozen, I assumed they would tell me which one to unfreeze to process. Instead denied and I will receive a letter in 30 days. I’ll be curious to see what it says. 🙂