Update 12/14/2024. BluPeak is back in the graveyard .. for now.

Update 9/1/2024. John from Bank Account Bonus Central made a youtube video yesterday stating that there is $5k of CC funding when signing up for a new SkyOne Federal Credit Union account. For more details see the SkyOne Federal Credit Union section below.Update 6/7/2024. Risen from the graveyard, BluPeak is now back, again offering $1500 credit card funding! I will continue to keep this list updated as often as possible. Please let me know if anything has changed.

The following is a list of bank accounts which allow $1000 or more in credit card funding:

US Bank Business Checking. $3000 in credit card funding — including Amex cards. $400 to $800 sign up bonus depending on deposit amount. Profitable Content.

US Bank Business Savings and Business Money Market. $3000 in credit card funding to each — including Amex cards. The savings account has no fee but the interest rate is horribly low. The money market account is 3.5% APY and also has a monthly fee of $15 if you have less than $10k in there.

By the way, I recently tried to open up a 7 month CD with US Bank to see if I could fund it with a credit card. They did not allow it. So I ended up not funding it. Just wanted to share in case anyone else got the same idea. It was a waste of time for me at least.

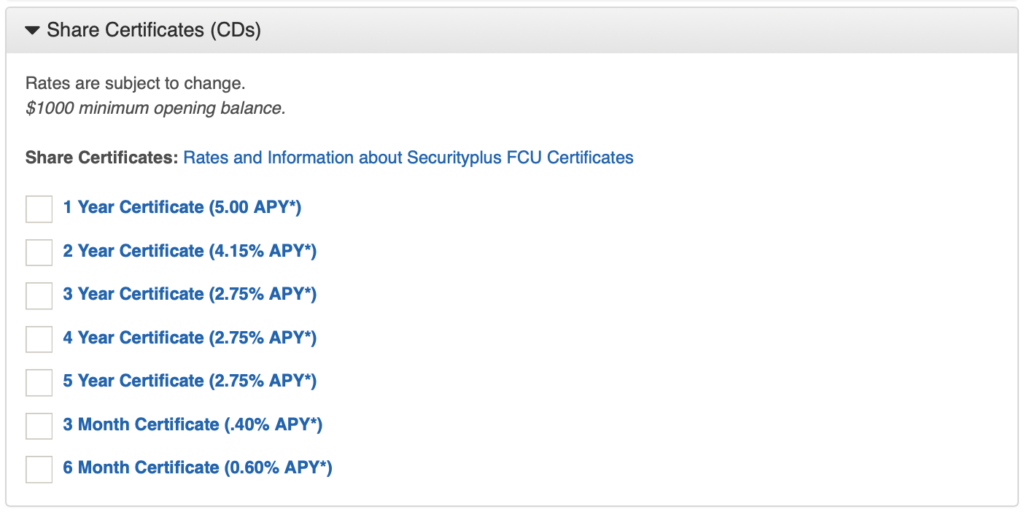

SecurityPlus Federal Credit Union. At the time of this writing, SecurityPlus offers $2000 in credit card funding when signing up for a new checking account with them. There’s also a $50 sign up bonus in the form of an Amazon gift card, using a referral. For the sign up details see Profitable Content. They also offer $2000 in credit card funding for various products such as CD’s, money market as well as savings — the 12 month CD looks decent at the time of this writing (6/8/2024):

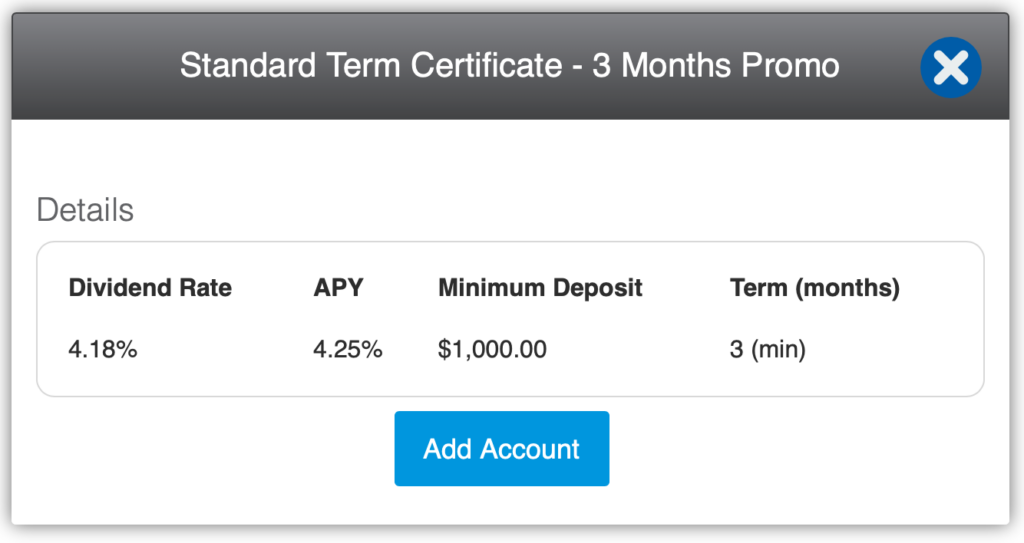

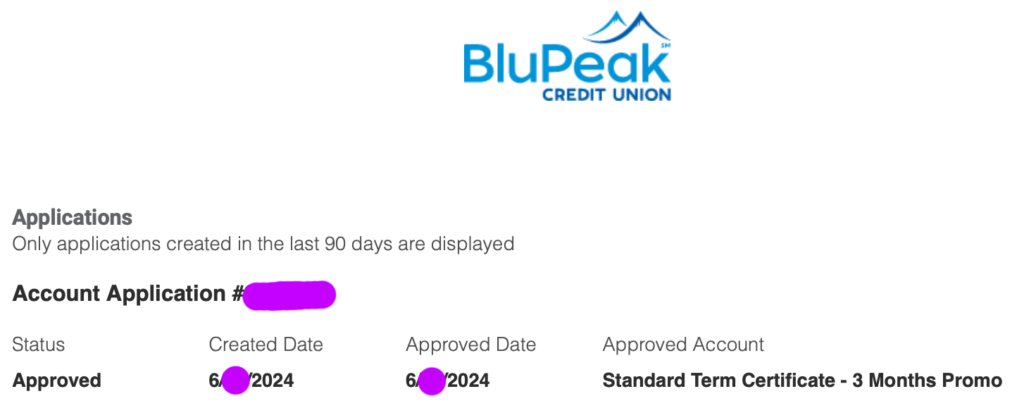

BluPeak Credit Union. [Update: 12/14/2024 — they are DEAD back in the graveyard.. for now] $1500 credit card funding is back for checking, savings and CD’s. I just logged on to the BluPeak portal very recently and am seeing a pretty good promo on a CD product: 4.25% APY for 3 month term; all of the other longer term promos were at 3.75% APY. (Regular rate on 3 Month CD at BluPeak is 0.25%.)

6/11/2024 DP: BluPeak very recently approved me for a 90 day 4.25% APY CD via $1500 credit card funding.

Wings Financial. Up to $6000 credit card funding on initial app. $1500 x four accounts. See BABC.

On Tap Credit Union. $1000 credit card funding per account. $150 sign up bonus. Profitable Content. In early July 2024, I signed up for this. I cc funded the On Tap checking account $1000 with my recently acquired Citi Strata Premier. I suggest just opening the checking account to start with so the initial cc fund of $1000 isn’t spread among accounts. At this time of writing, 7/6/24, On Tap offers a 9 month CD with 5% APY, which you can also fund $1000 with a credit card.

OnPath Federal Credit Union. $1000 credit card funding per account. $50 sign up bonus. 7% APY up to $10k. Profitable Content. (I’ll be signing up for this in the near future.)

SkyOne Federal Credit Union. John from Bank Account Bonus Central made a youtube video on 8/31/2024 stating that there is $5k of CC funding when signing up for a new SkyOne Federal Credit Union account. I don’t know much about the bank or what they offer. John’s referral link is in his video as a QR code. I will probably sign up to check it out. I am not sure whether or not they offer repeat $5k CC funding after the account has been open. From the video it appears the minimum duration of the CD is 6 months at 3% APY.

The Graveyard

- BluPeak is back in the graveyard. They currently don’t allow credit card funding. For some reason though I think this zombie will rise out of the grave again like they have in the past.

- Unify Federal Credit Union — used to be $2000 per account but is currently $100 at the time of writing this.

- Langley FCU — As per Butterboy’s comment below (9/8/2024), they are not currently offering CC funding at this time.

Chex Sensitive

All the following denied me in late 2023 with not all that many Chex inquiries. Not sure if these continue to offer credit card funding or what the limits are.

- Affinity Federal Credit Union. Profitable Content.

- Stanford Federal Credit Union

- GTE Financial. I have read it is $5000 per CD and $500 for other accounts, but I can’t personally confirm this as they denied me due to Chex.

- KeyPoint Credit Union

Other Resources

Doctor of Credit. Bank Accounts That Can Be Funded With A Credit Card

Some Tips on Certificates of Deposit

- Set a calendar event with alert on your phone to inform you when your CD matures. This way you can withdraw the funds as soon as possible, if you desire. If you wish to cash it out after maturity, I recommend doing this as quickly as possible as banks like SecurityPlus have a lengthy process to cash out a CD — more on SecurityPlus below.

BluPeak. I like how easy it is to close a CD with BluPeak. Just call them right after the CD matures, and they can do the entire thing over the phone unlike the experience I had with SecurityPlus.

SecurityPlus. They make you go through a series of steps to close a CD. They send a portal message to you each time but you don’t know they did because the portal doesn’t alert you via email or text that a new message is there; I don’t even see the message alert while logged into the portal! (I looked and saw no way to setup the alerts so you are notified.)

I think they do this deliberately. It took me over two weeks to cash out a CD because I didn’t know they’d make you jump through so many hoops, message after message. So check the messages every day there in their portal until the CD cash out is complete.

They sent me a message asking for me to fill out a form, sign it, scan and it send it back along with the front and back of my driver’s license. Then in the subsequent message they asked me to scan my latest utility bill. I did so and after that they asked me a question via yet another message “Thank you for your message; Can you please indicate who the document is addressed to?” My exact first and last name and address registered with the bank was at the very top of the bill. There was no other name or address. So it seems like they were deliberately playing games to stall the cashing out of this CD, knowing that most people won’t know they’ve gotten a reply until they login several days later to see if SecurityPlus FINALLY cashed out the CD.

So just expect a series of requests and manually log in every day and check the message portal. With all that said, I recently bought a 12 month CD with them at 5% APY, now that I know their process. When I make the next CD closure request and they ask for me to fill out and sign form along with attaching images of my ID, I will also scan my utility bill and also tell them “yes that is me who it is addressed to”. So it won’t this long string of messages from them in the future.

Update 9/1/2024. SecurityPlus seems to have improved things a bit with closing a CD via secure message. Just login though every so often to see if they sent you a SM; make sure to go to SM in the SecurityPlus portal as they don’t even alert you in the portal that there is an SM sitting there waiting for you to read.

Great article Cowgirl! I’ve heard reports that Keypoint CC funding is back, but I cannot confirm that yet.

Well this is good news. I’ll update the article if it’s true. They did deny me with not all that many Chex inquiries, so I haven’t been following it. Thank you for Cashback Cow’s very first comment!

Dizzy mentioned to me yesterday that John (BABC) put out a new video on Langley FCU which has $1000 in CC funding. I need to look into this. https://youtu.be/HU1w8Wvi5xs?t=157

I also need to look into University Credit Union which has $5000 in credit card funding. Is this still at $5k? I’ve heard it went down to $1k. Hopefully, temporarily.

for posterity, Langley FCU, at this time, does not offer CC funding

Thank you so much Butterboy, I’ll update the article now with this!

Is Skyone for checking and saving or only CD?

I signed up for US Bank Smartly Checking about a week or so ago and I was pleasantly surprised they offered $250 in credit card funding. Nowhere near the $1000 threshold for this blog post, but figured I’d mention it. The SUB for the checking account was very nice at $500.

Not $1000 in cc funding but worth mentioning. First United Checking [OK/TX] has $500 in cc funding also accepting American Express cards. I recently applied for it and was approved, funding it with $500 from my Amex Blue Business Plus card.

Wow – I never would have known the hassle of SecurityPlus cashing out – I don’t think that’s even been noted at DoC comments – though it must have been. Just opened a 12 month CD. What a ridiculous amount of hoops. BluPeak is super easy – I just send them a secure message. I also had no idea that they brought back credit card funding. I should have done a 3 month there instead of the SecurityPlus 12mo.

I haven’t notice any comments about it on DoC. Just figured it out myself after closing one a few weeks back. I have to close one again in a couple weeks, I’ll let you know how it goes this time with my plan to make it as fast as possible. Yeah BluPeak just very recently brought it back!

Were you able to do the BluPeak High rate Savings and High rate Money Market after doing hte Max Money Market and Preferred savings?

I haven’t tried that yet. Maybe I should instead of the 3 month CD?

How many 3 MO CDs do you have? 😀

I have one 3 month CD with them and one 9 month. An acquaintance of mine has done like 30k in CC funding with Blupeak in the past 10 months or so though. 🙂 Lots of 3 month CD’s.

How was closing your second Security+ CD different than the first one?

Yes, much easier. IIRC I just sent them a single message with all the details they might need and then they closed it without issue. But still have to manually check the message center each day to see if they have replied or did what I requested. I still didn’t get an alert there was a message for me there via email.

Interesting, I do seem to get email alerts for secure messages. I’m thinking of just closing mine early, it looks like it’s a pretty easy process. I sent them a message asking what my early penalty is and how to withdraw, and apparently now they have the request under “Secure Forms”, not sure if they were already doing that when you did yours. I might just take back my $$ and let them keep 90 days worth of interest, since the main reason I opened it was for SUB.

TJ, I’ll never close mine early. CC funding CD’s are too important to me. I don’t want to damage relationship with precious credit unions and other banks.

I don’t think it would damage it when the CDs are paying higher interest than their new CDs pay. It takes them off the hook.

Hi! Super newby question: How do I know my credit card won’t recognize the CC Funding as a “cash advance” and thus not give me points for it?

Only way is search for data points or trial and error

Citi used to be notorious for cash advance, but apparently things have changed.

When one calls Citi I notice the rep says they can’t lower Cash Advance limit to zero. They say things like $750 or $1000 or some other arbitrary higher limit. If you HUCA or even threaten to, I notice they will ultimately adjust it to $0 CA limit. I didn’t feel like a HUCA and told the rep that I would just call back and ask another rep to lower it to zero. That prompted her to get the “supervisor” to authorize it to be adjusted to zero. Seems deceptive that they try and force people to have some sort of CA limit, telling the customer there is no way to set it to $0. This also happened to my friend, but he had to HUCA. He also ultimately got it set to $0.

does anyone know if you already have wings checking, can you open up the other accounts and do the funding on the others with CC?

As a note, I signed up for Skyone through savings and checking account and they did not offer any sort of credit card funding.

I got denied for blupeak, but I selected a few accounts and it actually gave the option on $5k cc funding.

I’m doing the “SPLASH” checking bonus with Blupeak and was able to fund $5k on my Citi DC when I first joined the CU in October.

A month or so later, I decided to see if they would allow the same for an add’l account, & so went through a new app up to the funding stage. Saw $5k max and canceled the app because I wasn’t ready to put the extra on my card.

Just now, I went back to open that 2ndary savings and found the app process only allowed $1k. Disappointing, but I submitted the app for that amount.

I then got a secure message: “We have changed out business practices and no longer allow funding with a credit card. Please provide routing and account information for ACH funding.” (from memory; wording not exact.)

So…. Another graveyard resident.

Thanks, I updated the article.

GTE is dead again. RIP