Note: In addition to details about this bank account in this article, I also share a lot of organizational details how I manage bank account bonus hunting.

I very recently applied for a U.S. Bank Smartly Checking personal checking account for a $500 sign up bonus. I was approved with no problems.

I was pleasantly surprised they allowed me to fund the account with up to $250 via a credit card. I still have the $4000 spend requirement to meet on my recently acquired Citi Strata Premier, and well every little bit helps!

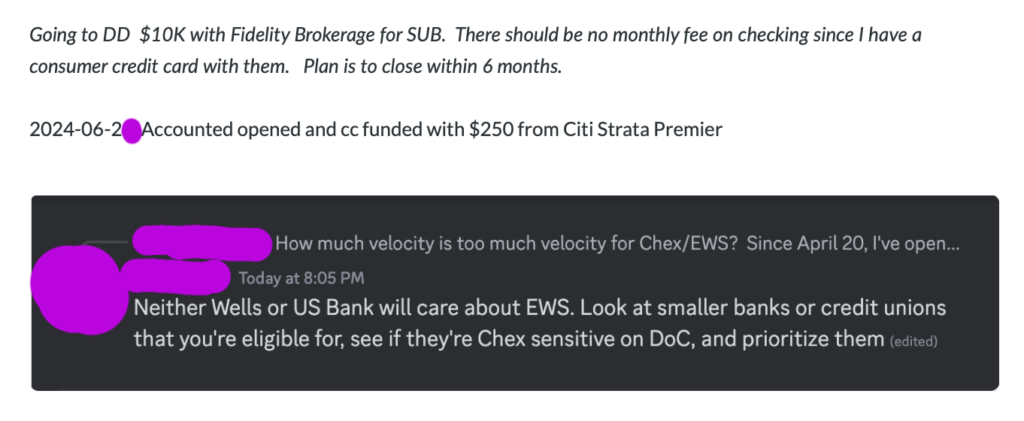

The bonus is $500 for direct depositing $10,000 within 90 days — and they aren’t too picky when it comes to the DD. I won’t have a monthly fee on this account since I have a couple personal consumer credit cards with them — I am assuming the Cash+ is a qualifying consumer credit card. See Profitable Content blog post on it for the details on this deal.

I have several bank accounts on my list to sign up for. I sorted by deal “valid through” dates to figure out which ones I needed to sign up first, and this Smartly checking was at the top of the list. The cut off date for this is in a few days on June 27, 2024.

I’ll report back with datapoints after they pay out.

I am out of state and initially got into the US Bank ecosystem by opening a Self Directed Brokerage Account with them — something I learned from one of RJ’s videos a while back. I now have several accounts with them both personal and business.

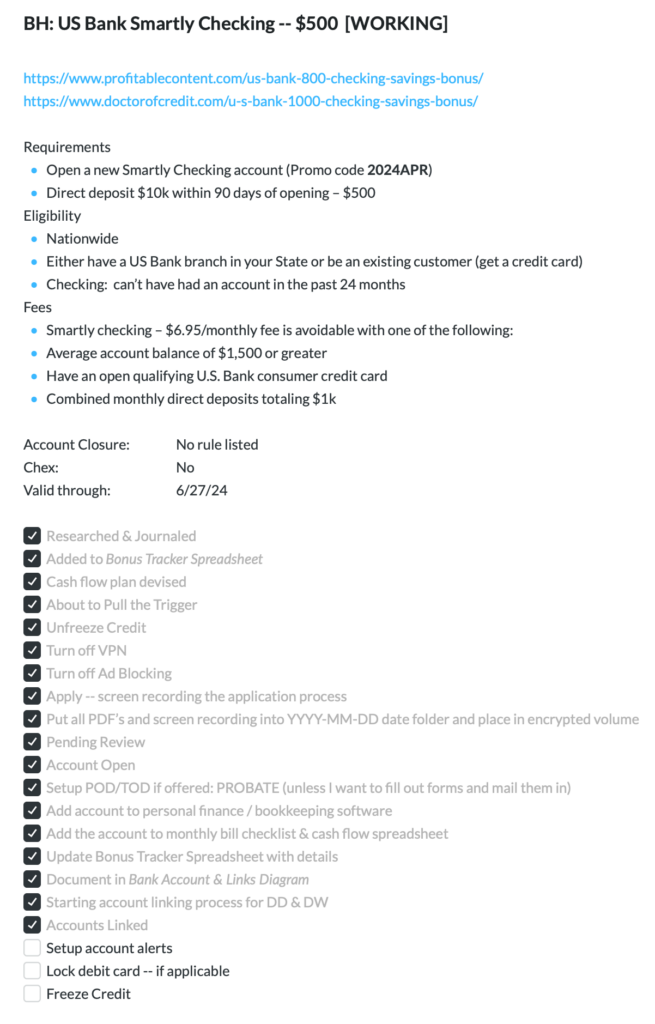

Below is a screenshot of my Day One journal entry for this deal, as an example of how I document these deals: title, deal links, deal details, checklist, plan, datapoints, etc.

I include the status of the account in the title — in this case [WORKING] which means the account is OPEN and working it for the bonus — previously the status for this account deal was [CONSIDERING]. Other statuses are: [PENDING], [DENIED], [AGING], [REFERRAL], [CLOSED], etc.

I also include “BH:” at the beginning of the title, which means bonus hunting, which allows me to more easily search my journal — e.g. “BH Smartly” would bring up this journal entry in the search results.

After the title, at the top of the entry are relevant links to both Profitable Content and Doctor of Credit. Followed with essentially a copy and paste of what’s on Profitable Content’s blog page, to the journal — RJ formats his pages in a neat concise & consistent format to tell you everything you need to do for the deal.

After the details of the deal is the checklist. I copy and paste this checklist from a template. It ensures I go through all the steps in the order needed. Day One makes it easy to implement checklists which I like.

After the checklist, I lay out my plan followed by datapoints — see journal entry screenshot below. And at the end of the journal entry, I can throw in screenshots, pdfs, other links or whatever I want.

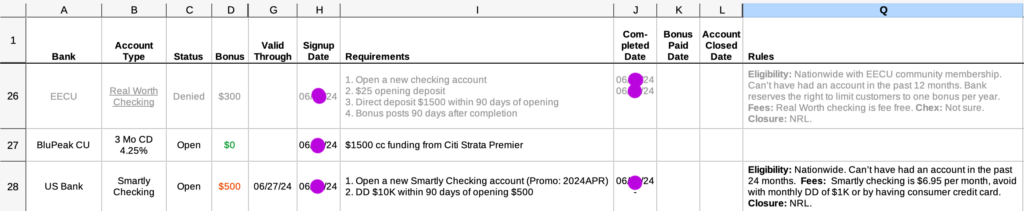

And here is a screenshot from my Bonus Tracking Spreadsheet for this deal:

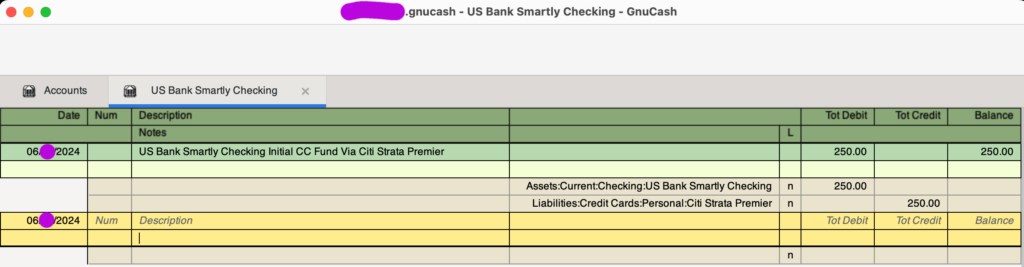

I also have created a US Bank Smartly Checking account in my personal finance software — I am using the free bookkeeping software GnuCash. Here is my bookkeeping journal entry for the cc fund of this account:

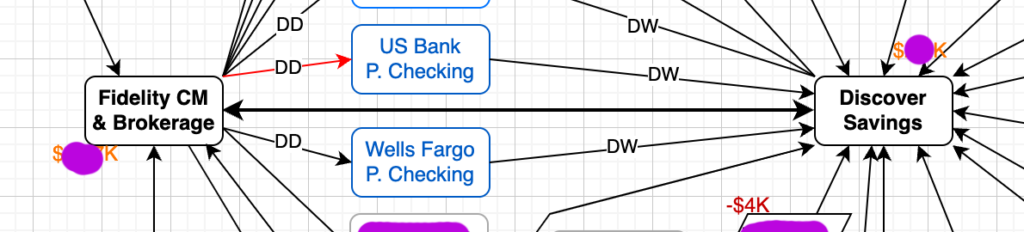

And the following screenshot is from my bank links diagram with this account added. I am DD’ing with Fidelity and DW’ing with Discover Savings. (I am also working Wells Fargo for a $325 sign up bonus now in similar fashion.) The red DD link from Fidelity to US Bank Smartly Checking is red because I need to verify microdeposits sent to Smartly Checking from Fidelity in a couple days. The red link visually reminds me to do this without having to read a journal entry to be reminded or having to setup a calendar event alert.

Could you please share RJ’s video about opening a Self Directed Brokerage Account? I couldn’t find anything like that in his website

I believe RJ said that trick no longer works. IIRC I think I’ve heard the best way to get in now, from OOS, is to open a business checking account?

Probably I’ll try opening business checking account. U.S. Bank does have some excellent bonus that I don’t want to miss.

Yeah they provide an insane amount of value between their DDA’s & Credit Cards — both personal and business.